Are You a Business Owner or Advisor?

Business Tax Incentives

8X PPP Funds Available

Does your company need better cash flow? Having trouble securing a small business loan from your bank or the SBA? You’re not alone.

Many small and midsize U.S. businesses are undergoing unprecedented financial stress trying to recover from the covid pandemic. Sales revenues in many industries were hard hit by social isolation mandates and covid’s other adverse business impacts.

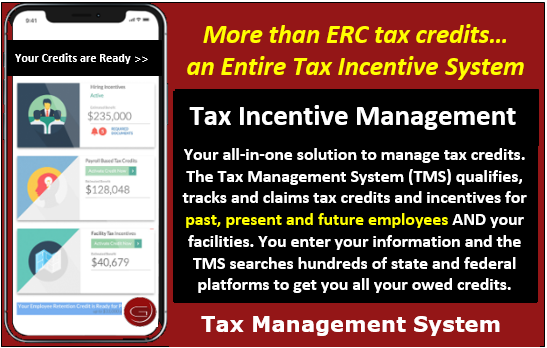

If you were unable to secure a Paycheck Protection Program loan or found it was inadequate for your cash flow needs, you should know there are other government incentive programs for U.S. businesses with potential cash flow benefits that are 8X the amount that was available with PPP loans – and these never need to be repaid.

No one else can stack employer tax incentives like our Tax Incentives Management System to assure your business captures every incentive for which it is eligible – with no fees unless we find new cash flow for your business.

Use our online screening tool to see if your business is eligible for one of the many federal and state tax incentives that generate an average of over $240,000 in new cash flow for our clients – and none of it has to be repaid.

To see if your business qualifies, click the image below:

___________

Employer Incentives

Numerous surveys of business owners confirm their biggest challenges are inadequate growth of working capital, cash flow and profits.

Because businesses are so focused on generating more sales, however, they often overlook a simpler way to address all three. The best part is it can be done without needing more sales and with no financial risk…

WORKING CAPITAL

that’s Fast & Risk-Free

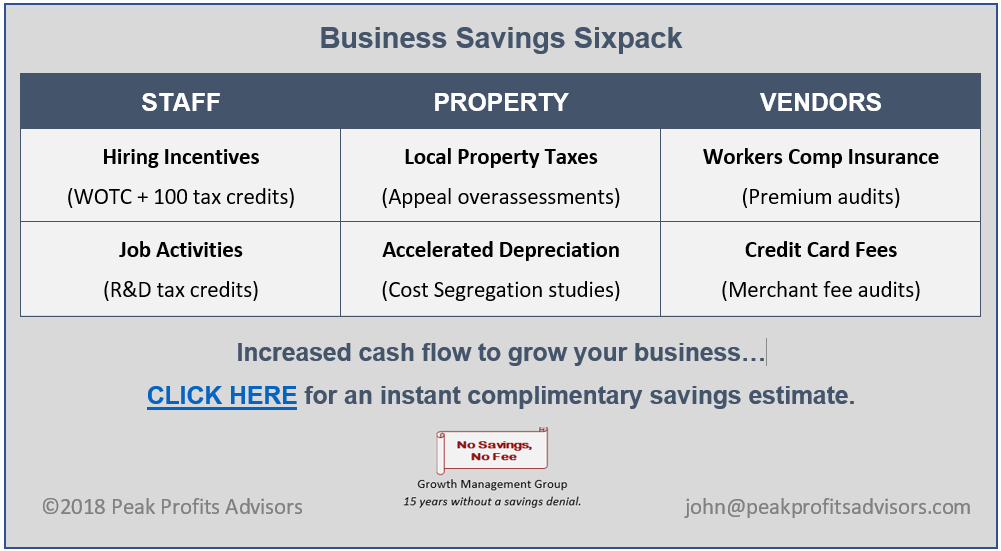

Before taking on more company debt – assuming it’s available to you – or selling precious equity in your company to raise working capital to grow your business, consider these risk-free cash flow solutions to fuel your business growth…

See how much your business may be eligible for in hiring incentives & property tax savings with our instant and complimentary tax credit calculator.

DIFFERENTIATE

for Growth & Retention

Competing in today’s commoditized accounting, insurance, and financial planning industries requires practice differentiation. Partner for proven specialized tax services to increase your value to clients and prospects…

Insurance & fin. planners – click here.

Improve your value to clients by delivering risk-free working capital to improve their cash flow and open more doors to add new clients.

Let us put our capital to work for your business, along with our proprietary software and 19+ years of specialized tax services expertise.

That’s what Keller Williams Commercial did when it chose Our “No Savings, No Fee” cost savings provider – Growth Management Group, or GMG – as its national preferred cost segregation provider.

This 5-minute video demo shows how we screen businesses to pre-qualify them for relevant tax and operating savings. See how to pre-qualify for more working capital that never needs to be paid back…

We Know About Growing a Business

Grow YOUR business…

What Clients Say

“We realized a considerable savings that would’ve otherwise gone to the IRS. We now understand why you are the leader in Cost Allocation Studies.” Sandra, Holiday Inn Franchise Owner

“Our accountant told us about this opportunity after we did our remodel but indicated that the cost could possibly outweigh the benefits. After having our plan done by GMG and utilizing it in our tax preparation our accountant tells us that it was a very good investment that will recoup itself many times over in the years to come.” Linda Barkey, Medical Facility Owner

Frequently Asked Questions

There’s no fee if we’re unable to find your business any savings across the specialized tax incentives and vendor audits we conduct for you. In the rare worst case scenario where no savings are found, you’re reassured your business is operating at optimal lean efficiency with no fiscal waste. And it costs you nothing. “No Savings, No Fee.”

Some large accounting firms provide some of these services, though not as comprehensively and not on a contingent fee basis. This means you could end up paying more in their fees than you save for your business. Most accountants, however, lack the specialized expertise – structural engineering. intellectual property law, etc. – required to successfully claim these tax savings. Our work provides the necessary documentation for your accountant to file with the IRS or other taxing authority.

In 23+ years of performing specialized tax incentive services and over a million in-house studies, our company has generated over $37 Billion in client savings and never had a single denial of savings for its clients. Our proprietary software incorporates industry best practices that optimize tax credits, refunds and deductions. All while conforming with relevant constraints. Which is why we provide audit defense support at no additional cost if there were ever an audit of our work.

This is also why we’ve been chosen as a national preferred provider by Keller Williams Commercial, many trade associations and accounting and financial services firms as their specialized tax services partner.

Most clients benefit from multiple savings opportunities, with hiring incentives like the Work Opportunity Tax Credit (WOTC) and credit card merchant fee and workers comp audits applicable to most businesses. Client average $240,000 in combined savings from three or more service categories. This has amounted to over $37 billion in aggregate client savings to date.

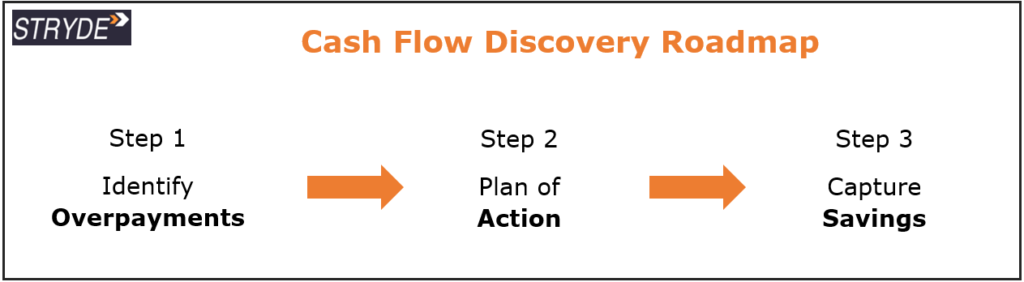

When you click on the above image and enter your industry and annual hiring experience, you’ll receive an initial estimate of your probable tax credit savings given our past experience with WOTC and other hiring incentives for your industry, as well as potential R&D tax credits depending on your industry. From there, we’re able to analyze your business for other potential savings opportunities you can pursue in whatever order you prefer.

For a no-obligation initial estimate, simply click here.

If you like what you see, click on the “Activate Now” button at the top of that page to get started.

Or contact me to discuss how we can help you meet your business needs more cost-effectively.