ERC Tax Credit Can Still Be Claimed

The ERC tax credit can still be claimed in 2022 and beyond by eligible U.S. companies. These are companies that were adversely impacted by the COVID pandemic and have not yet fully claimed it.

This employer tax credit rewards employers for retaining employees on payroll despite government-ordered shutdowns and other COVID-related adverse business impacts.

This employer tax credit is effectively a payroll tax refund that can quickly increase qualifying companies’ after-tax bottom lines.

The ERC tax credit is applied against the employer portion of payroll taxes. This means it can have an almost immediate cash flow benefit for eligible employers.

And according to the IRS “…if the employer’s employment tax deposits are not sufficient to cover the credit, the employer may get an advance payment from the IRS.”

This effectively makes it a payroll tax refund with immediate cash flow benefit.

Who Is Eligible for the ERC Tax Credit?

Private employers, including non-profits, carrying on a trade or business in 2020 through September 30, 2021 that:

- Had operations partially or fully suspended as a result of orders from a governmental authority due to COVID-19, or

- Experienced a decline in gross receipts by more than 20% (previously 50% in the CARES Act) in a quarter compared to the same quarter in 2019 (eligibility ends when gross receipts in a quarter exceed 80% of the same 2019 quarter).

Employers who received a Paycheck Protection Program Loan (PPP) were previously not eligible for this tax credit.

However, that was revised to allow access to both programs while avoiding double-dipping. Any payroll costs covered by a PPP loan can’t also be used to qualify for the ERC tax credit.

How Much Is The ERC Tax Credit?

The ERC tax credit is a 70% credit for the first $10,000 of earnings paid per quarter after March 12, 2020 and before September 30, 2021 per eligible employee. This amount can include the employer portion of health benefits.

For every eligible employee who earned $10,000 or more per quarter during this time period the ERC tax credit provides the employer with a $7,000 tax credit (the maximum tax credit allowed per quarter).

For January to September 30, 2021, this represents a potential $21,000 tax credit per employee kept on the payroll and a combined $26,000 per eligible employee maximum for 2020 and 2021.

This can be claimed and applied retroactively for businesses that haven’t yet claimed the ERC tax credit.

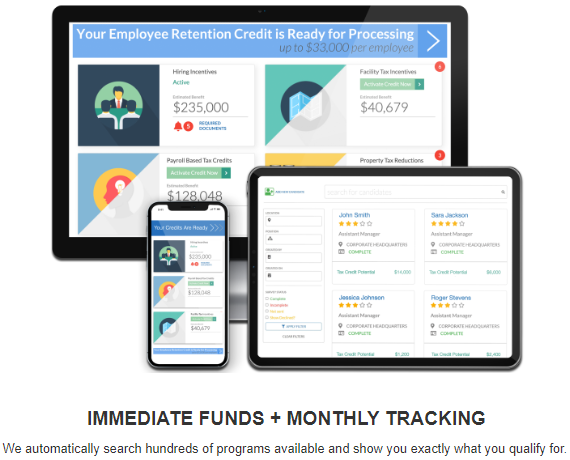

Growth Management Group’s Tax Management System can help provide immediate funding for U.S. businesses and monthly tracking of results.

Beware ERC Hype & Fly-By-Night Operators

Unfortunately, the ERC tax credit has drawn an army of marketers promoting ERC relentlessly and over-promising while under-delivering.

Many wouldn’t know a tax incentive from a ham sandwich before now (and many still don’t).

Yet business inboxes are inundated with ERC hype. Much of it is from entities with little or no track record of successfully processing business tax incentives.

But ERC isn’t some fiscal fad to be so easily exploited by inexperienced marketers.

It’s one of many – hundreds – of perfectly legitimate and even highly encouraged tax incentives that your business may qualify for but likely isn’t capturing due simply to the complexity of doing so.

This has left too many eligible businesses from claiming these significant tax savings to which they’re legitimately entitled.

Others are capturing only a fraction of the full tax saving incentives they deserve – both ERC and beyond.

Hundreds More Tax Incentives

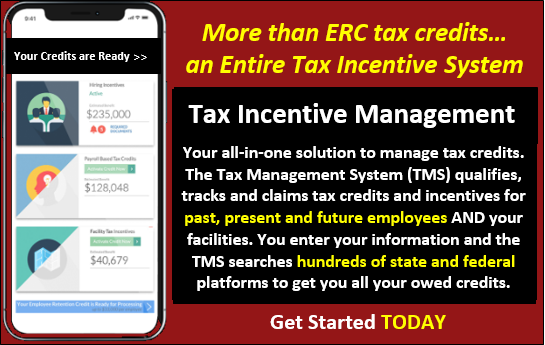

The ERC tax credit is one of hundreds of available state and federal tax incentives.

Growth Management Group’s comprehensive and time-proven Tax Incentive Management System (TMS) simplifies and amplifies these tax incentives and savings by searching and managing them for business clients and their CPAs or Accountants.

It’s built on almost 20 years of unblemished success in working with client companies’ CPAs and Accountants to capture hundreds of millions of dollars in tax savings and incentives.

These tax savings and incentives across hundreds of state and federal tax incentive programs are all provided on a risk-free “No Savings, No Fee” basis.

GMG’s TMS is comprehensive, user-friendly, highly automated and time-tested. It’s the exact OPPOSITE of fly-by-night.

A Lot More Than ERC

Find out on your own time, at your own convenience – without having to speak to anyone – how much your business qualifies for in tax incentives. And not just ERC credits.

You can even self-activate the process to get started – with the click of a button.

Or you can discuss it with our team of experts at your convenience using the Contact tab above.

Your time is valuable. Use it to save and retain money, not spend it.

You can learn more about it – and even get started today – by clicking on the image below.

Calculate in 60 seconds. Without having to speak to anyone.