How It Works – Hiring Tax Incentives

Capturing Hiring Tax Credits

Couldn’t Be Simpler…

NOTE: Due to the ongoing coronavirus pandemic’s impact on U.S. businesses, the WOTC program has been expanded to apply to not just new hires but to also reward retention of current employees via an Employee Retention Tax Credit (ERC) of up to $33,000 per employee retained during the period of 3/12/20 to 12/31/21, with the benefit paid by foregoing the employer portion of the employer’s payroll tax obligation. Tax credit amounts due in excess of payroll taxes can be claimed as refundable tax credits for immediate cash flow benefit for eligible employers.

In addition to these improvements to the ERTC, the federal coronavirus stimulus package approved by Congress in December 2020 extended the WOTC program for an additional five (5) years.

Federal Work Opportunity Tax Credits (WOTC) are general business tax credits for employers that hire job candidates from any of ten categories of underemployed target populations. The credits can offset federal income taxes and can be carried back to the prior year or carried forward 20 years.

Target categories include military veterans, long-term unemployed, SNAP (food stamp) recipient families, empowerment zone residents, summer youth workers and other underemployed target populations. Credits average $2,400 per eligible new hire and for disabled veterans unemployed for six months or more are up to $9,600 that’s deducted dollar-for-dollar from corporate tax payments

Many employers know about WOTC, but have avoided them due to their cumbersome, complex and intrusive eligibility and registration requirements. Not wanting to get involved with prospective employees’ personal business – required for them to qualify for WOTC credits – has been another obstacle preventing the widespread adoption of these potentially lucrative tax credits.

This has prevented most employers from capturing the competitive benefits a well-managed WOTC program provides by boosting their bottom line after-tax profits without having to generate more sales.

Reduce Hiring Costs and Risks

Work Opportunity Tax Credits are only one of over 100 federal, state and local hiring incentives that reward employers for recruiting new hires from the traditionally underemployed target populations from which many employers already recruit new hires.

Prospective employees that qualify for these hiring incentives – substantially reducing their employers’ financial risk during the highest risk period of initial employment – have an obvious advantage over those candidates without this recruitment cost offset, but only if prospective employers have access to their qualifying tax credits amounts.

But the red tape and confidentiality needs of prospective employees have been enough to keep these benefits out-of-reach for prospective employers.

Until now.

Recruit More Effectively

Record low unemployment rates mean record difficulty in recruiting and retaining new hires. One potential use of these tax savings is to redeploy some of it to enhance wages and benefits to better compete for talent in today’s highly competitive recruitment arena – making for a “win-win” for employer and employee alike. And when employees do move on, you’re able to lower your costs of recruiting their replacement by leveraging these available tax credit hiring incentives.

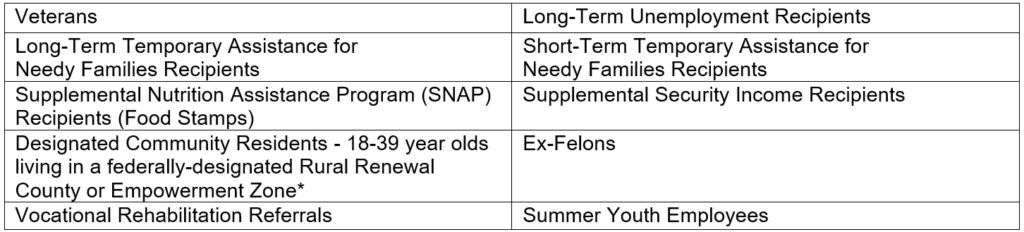

WOTC Target Populations

Eligibility for WOTC tax credits has increased substantially over the years and now includes ten (10) categories of traditionally underemployed populations of U.S. citizens that include the following:

Target Populations

*To locate Empowerment Zones, visit the EZ Locator at: http://egis.hud.gov/ezrclocator/.

How Tax Credits are Applied

Taxable Employers

After an employee has been qualified and the certification secured, a taxable employer may claim the tax credit as a general business credit against their income tax using IRS form 3800.

Sole Proprietorship, S-Corp, LLC, LLP or Partnership

The credit passes to the owner, shareholder, member or partner in the same manner as losses are allocated.

C-Corp The credits are used by the corporation.

Tax-exempt Employers

Employers who are qualified as tax exempt as described in IRC Section 501(c) and exempt from taxation under IRC Section 501(a), may only claim the WOTC for qualified veterans and may not claim for other target groups.

After an employee has been qualified and the certification secured, tax exempt employers may claim the credit against the employer social security tax using IRS Form 5884-C. Form 5884-C ‘Work Opportunity Credit for Qualified Tax-Exempt Organizations Hiring Qualified Veterans’ is filed after filing the related employment tax return for the employment tax period for which the credit is being claimed.

How GMG’s WOTC Service Works

Capturing Hiring Tax Credits

Couldn’t Be Simpler…

GMG’s paperless process for screening job applicants and optimizing eligibility for WOTC (Work Opportunity Tax Credits) and other hiring tax credits is simple:

- Job candidates answer a few simple questions using our proprietary software

- You receive instant feedback on potential Local, State, & Federal Hiring Tax Credits

- Upon hire, we automatically submit the necessary paperwork for approval

- Once approved, we provide necessary payroll documents to receive the benefit.

Your Manager Enters Candidate into Our Proprietary System

And your screening part is done.

Documents Sent Automatically to State Workforce Agency (SWA)

In compliance with 28-day rule via Client Portal for eligibility determination so qualified candidates never slip through the cracks…

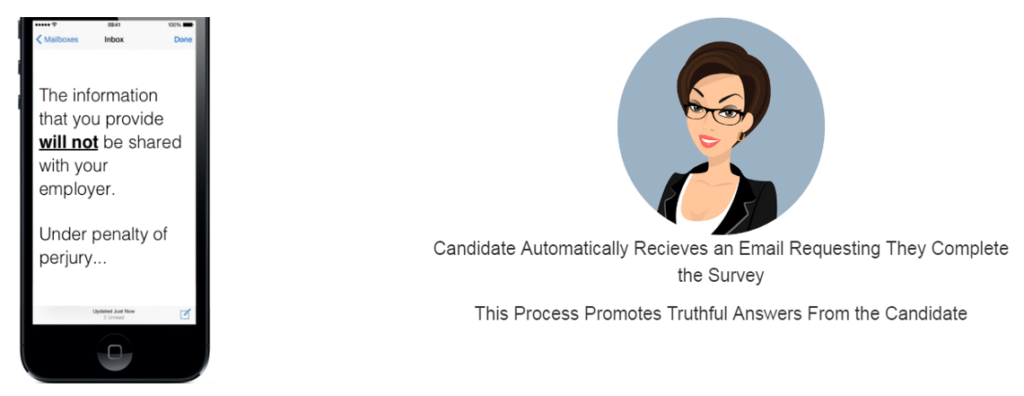

Candidate Is Automatically Emailed Survey Request

And informed their responses aren’t shared with employers, which results in more honest responses and comprehensive screening for the over 100 federal, state and local hiring incentives GMG’s software screens job candidates for.

SWA determines eligibility & returns certification via Client Portal

Employer uses Client Portal reporting system to submit & track employee hours worked and file for their tax credit with the IRS and/or other government agency.

Stay abreast of candidates’ status.

Redeploy Your New Tax Savings to Meet Your Business Needs

Put your newfound funds to better use…expand service offerings, find new clients, bolster retirement plans, be more attractive to acquirers…grow your business.

Getting Started on Hiring Tax Credits Is Simple, Too…

GMG’s hiring incentives service combines automation technology with human skills to optimize capture and compliance rates for WOTC and all other hiring incentives.

This comprehensive outsourced service includes:

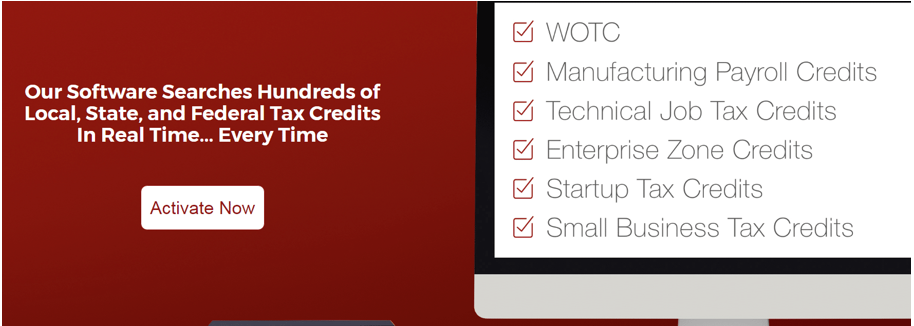

- Proprietary software that scours the internet in real-time for information about candidates’ potential eligibility for hundreds of local, state and federal hiring incentives – improving accuracy, and not just for WOTC;

- Highly-trained back office specialists seamlessly screen job candidates for hiring incentives while assuring them their responses won’t be shared with prospective employers – increasing truthfulness of responses; and

- Assurance of timely submission of documentation required by state certifying agencies so no eligible candidates fall through the cracks – all with no disruption of your personnel or business processes.

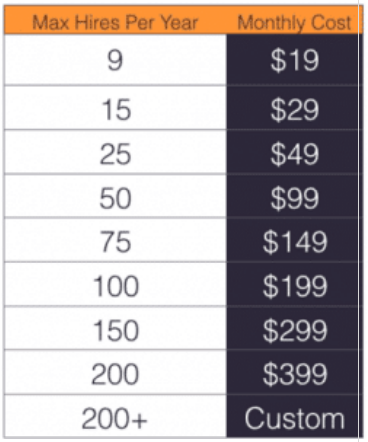

At Much Lower Cost to Gain These Benefits for Your Business

Despite this broader reach and range of services, GMG’s monthly fee structure is a fraction of the compound charges levied by traditional WOTC providers.

The table below reflects GMG’s monthly sliding fee schedule for unlimited eligibility searches that’s based on the number of annual new hires by your firm.

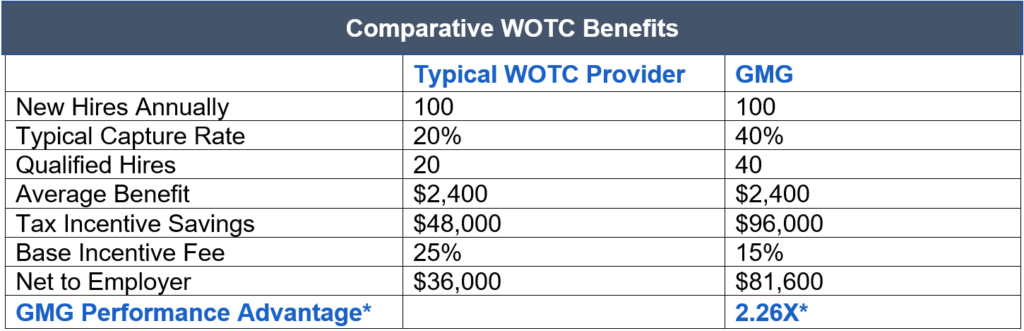

The true value of GMG’s breakthrough WOTC service is its superior ability to capture more eligible candidates with its more comprehensive screening of a broader universe of over 100 hiring incentives available today…

Whether you hire one in ten or one in a hundred job applicants, we screen them all and your monthly fee is based only on those eligible candidates you actually hire.

*Before lower processing charges that further improve GMG’s performance vs. typical provider.

*Before lower processing charges that further improve GMG’s performance vs. typical provider.

If you’ve had any prior experience with WOTC providers, you’ll appreciate how affordable these monthly rates are by comparison, especially given GMG’s more comprehensive services, unlimited searches and performance advantages – all of which make GMG today’s best WOTC value.

Get Started Now…

You can capture these financial and competitive benefits with a simple click of the button below. There’s no activation fee, no long-term contract and you can cancel at any time.

You can literally be enrolled in minutes and have our team of hiring incentive specialists start to screen your very next job applicant today for WOTC and various other hiring incentives that could generate up to $9,600 in tax credits per eligible new hire for your business.

Check out our online WOTC Calculator to see how much you may be entitled to receive. If you like what you see, you can get started immediately by clicking on “Activate Now”.