Six Sigma Your Taxes

Lean Manu-TAXING

U.S. manufacturers know all about using Six Sigma lean manufacturing practices to squeeze waste from their operations, but often ignore waste in their taxes.

Even the IRS says you’re probably overpaying your taxes by failing to take all the tax deductions available to your business.

And an estimated 95% of U.S. manufacturers – mostly small and mid-size manufacturers – are failing to claim billions of dollars in tax credits for which they’re eligible.

Are you one of them?

Because if you are, you need to apply the lean thinking you use to improve your manufacturing processes to your corporate tax planning as well.

Doing so can boost your cash flow to better address other business challenges and allow you to reinvest your newfound tax savings into growing your business.

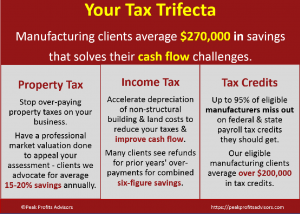

$270,000 Average Savings

In addition to fixing your depreciation reporting and claiming tax credits your business deserves, we often appeal local property taxes for our manufacturing clients. On average, this produces 15-20% in recurring tax savings.

Our manufacturing clients often qualify for all three of these tax savings studies for an average $270,000 in new cash flow. Our studies provide your CPA or accountant with the supporting documentation they need to file for these savings.

How much in new sales would you need to produce a $270,000 impact on your bottom line – and on your cash flow?

And if we find no savings, there’s no fee for our professional services…No Savings, No Fee.

To use our online tax savings calculator for a free and instant estimate of your potential tax savings – based on our proven experience with thousands of client tax savings and credits – click here.

xxx____________________________

xxxx

This publication does not constitute professional advice.

IRS Circular 230 Disclosure – To ensure compliance with IRS requirements, you are informed that any U.S. tax advice contained in this communication (including any links or attachments) is not written or intended to be used, and cannot be used, to (i) avoid tax-related penalties under the Internal Revenue Code, or (ii) promote, market, or recommend to another party any transaction or matter addressed herein.

© 2015-2021 Peak Profits Advisors – All Rights Reserved

The contents of this web site and all related materials or printed matter are owned by Peak Profits Advisors and protected under the United States Copyright Act pursuant to U.S. and international copyright laws.