Cost Segregation and Accelerated Depreciation [Video]

Cost Segregation and

Accelerated Depreciation

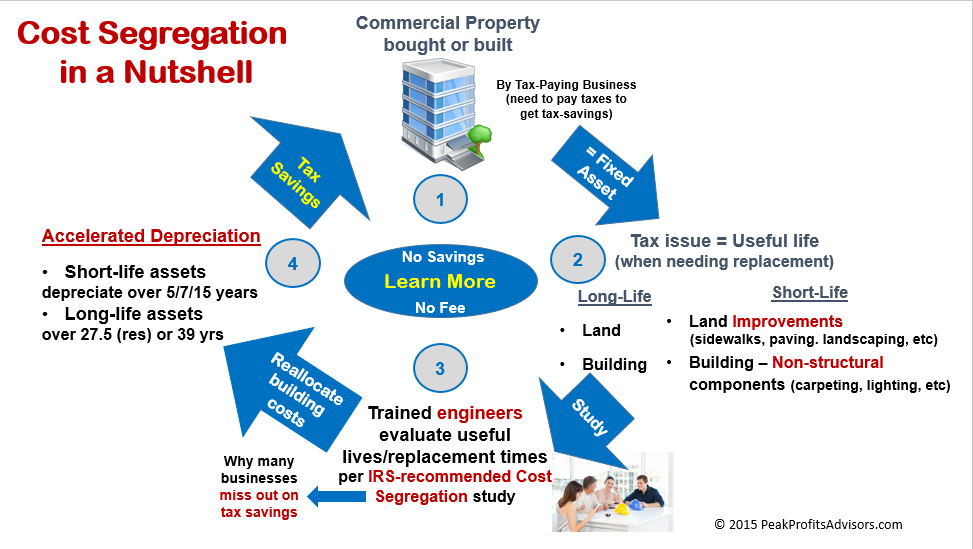

While cost segregation may not be familiar to many, most business owners have at least heard of accelerated depreciation and are generally aware of its favorable impact on their bottom line. In a nutshell, it reduces your taxable income so you pay less in taxes in the near term, while paying more in future years after your shorter periods of accelerated depreciation have passed.

Deferring taxes in this manner almost always translates into a net present value benefit for income-producing property owners.

You’re depreciating the same total costs for your building and land improvements, but doing it more accurately than the standard 39-year straight-line method of depreciation for commercial properties (27.5 years for residential properties like condos and apartment buildings).

Falling Through the Crack

Between Accounting & Engineering

The reason you may not currently be using this more accurate depreciation method for your commercial properties is that it requires an engineering study – technically called a cost segregation study – to properly allocate your building and land costs into their respective categories based on their useful lives, or expected replacement lives.

Since most accounting firms don’t employ engineers, this occupational gap has worked to the government’s advantage. Since only the very largest accounting firms are generally able to offer cost segregation services, the government is able to effectively increase corporate tax revenues for many businesses. That’s because taxable incomes are often overstated because they fail to capture the full cost of building components that will need replacing in less than 39 years (think carpeting, cabinetry, wiring, HVAC, etc).

Cost segregation depreciation on accelerated bases generally ranges from 20-40% of total building costs, which means there can be substantial dollars involved. Combined with the fact that you’re often able to recover prior over-payments based on these less accurate depreciation schedules and many businesses can recover hundreds of thousands of dollars and more by fixing this depreciation problem.

Cost Segregation In A Nutshell

This image summarizes” Cost Segregation In A Nutshell” …

And here’a quick video explaining it in more detail:

Six-Figure Savings & More

With Cost Segregation Accounting

Whether your business needs a cash flow boost or you’re just tired of paying more in federal, state, and local property taxes than you need to – and whether you’ve already filed your tax return or not (this isn’t just about one year’s tax filing) – cost segregation studies are an opportunity to plug any holes in your business taxes and lower your tax payments for years to come.

For many businesses that qualify – and more than two out of three business qualify – a near-term tax savings of six and even seven figures is possible, with an immediate and significant bottom line and cash flow benefit.

And the best part is you don’t need to spend more on advertising, conduct another sale, or layoff employees to realize these savings. If anything, their jobs – and yours – will be more secure with stronger bottom line profits. And your shareholders or other business owners will be assured their business is being vigilant by paying no more in taxes than is legally required.

In that regard, it’s important to emphasize that detailed engineering-based cost segregation studies are actually recommended by the IRS, as well as by the accounting profession.

And you can have a quality cost segregation analysis performed – with experienced cost segregation professionals with a decade’s worth of clients savings in excess of $300 million – with no up-front cost or financial risk…No Savings, No Fee.

To see what tax savings your business may qualify for – in minutes – click here.

To learn more, contact us.