Lean Manu-TAXING: Tax Credits and Deductions

Six Sigma Your Taxes

U.S. manufacturers know all about using Six Sigma lean manufacturing practices to squeeze waste from their operations, but often ignore waste in their taxes.

Even the IRS says you’re probably overpaying your taxes by failing to take all the tax deductions available to your business.

And an estimated 95% of U.S. manufacturers – mostly small and mid-size manufacturers – are failing to claim billions of dollars in tax credits for which they’re eligible.

Are you one of them?

Because if you are, you need to apply the lean thinking you use to improve your manufacturing processes to your corporate tax planning as well.

Doing so can boost your cash flow to better address other business challenges and allow you to reinvest your newfound tax savings into growing your business.

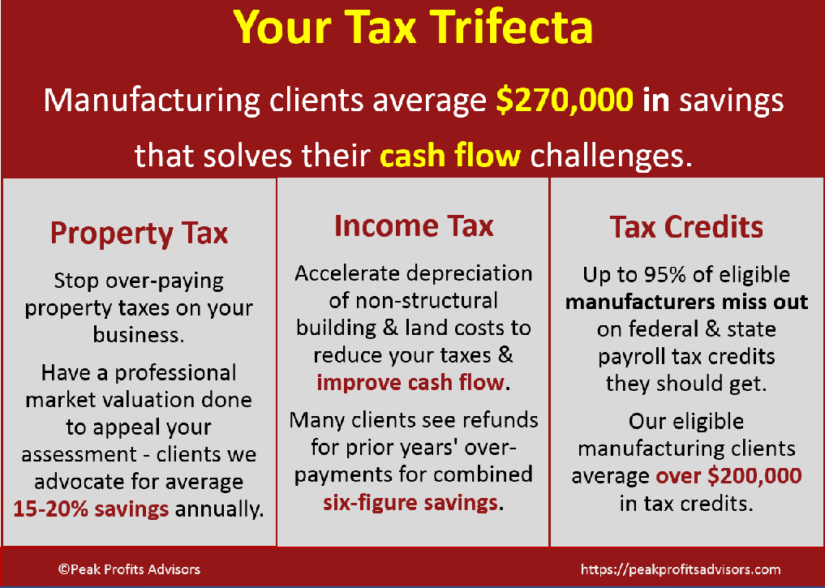

$270,000 Average Savings

In addition to fixing your depreciation reporting and claiming tax credits your business deserves, we often appeal local property taxes for our manufacturing clients. On average, this produces 15-20% in recurring tax savings.

Our manufacturing clients often qualify for all three of these tax savings studies for an average $270,000 in tax savings.

How much in new sales would you need to produce a $270,000 impact on your bottom line – and on your cash flow?

No Savings, No Fee

One aspect of Six Sigma is to address a serious issue needing close attention for quick resolution. You can apply that to your business taxes by outsourcing the engineering-based studies required to maximize your tax savings in the safest and most expeditious manner.

That’s the most prudent course because accountants serving small and mid-size manufacturers don’t generally employ engineers and IP attorneys. They’re simply not equipped to undertake the kind of complex and inter-disciplinary studies the IRS recommends to prove you deserve these tax refunds and tax credits.

There’s no excuse to keep falling through the cracks between accounting and engineering. We’ll work with your accountants to help them file the necessary documents to claim the savings we find for your business.

And if we find no savings, there’s no fee for our professional services…No Savings, No Fee.

Engineering-Based Tax Incentives

Key goals of a Lean Six Sigma process are to lower costs, reduce defects, and improve quality.

When it comes to corporate taxes, however, many manufacturers that own their buildings continue to use simplistic 39-year straight-line depreciation rather than the more accurate engineering-based depreciation of shorter-lived building components – like some plumbing, HVAC, and other building components – that are more accurately depreciated over 5 or 7 years.

The difference this accelerated depreciation produces averages six figures in tax savings, reduces tax obligations for several years, and boosts cash flow quickly and significantly.

Not only is this engineering-based approach to property depreciation more accurate, the IRS actually recommends it.

This kind of tax minimization for manufacturers – or lean manu-taxing – reduces the defects in the straight-line method of depreciation, improves the quality of your tax reporting, and reduces tax costs.

Six Sigma your taxes, anyone?

Payroll Tax Credits

An even greater oversight by many manufacturers is the failure to claim legitimate tax credits because they don’t think they qualify. As noted earlier, an estimated 95% of eligible manufacturers – that’s 95% – are failing to claim R&D tax credits because they suffer the delusion that only high-tech laboratory research and breakthrough technologies qualify.

This is an expensive misconception.

Payroll is every manufacturer’s biggest expense – and their biggest competitive disadvantage in our global economy. Yet the vast majority are failing to reduce their payroll burden by capturing the special tax incentives that reward certain manufacturing payroll activities.

Payroll costs for even relatively mundane product and process improvements qualify – and they only need to be new to your business, not an industry breakthrough. Simple quality improvement activities often qualify.

The requirements for R&D credits have been substantially loosened over the years – most significantly just last year when small and mid-sized manufacturers were allowed, for the first time, to use a simplified filing process for these tax credits. This allows retroactive capture of tax credits by expanding the number of years for claiming tax credits from just the current filing year to now up to four prior years.

This means many manufacturers that may have previously only been entitled to a five-figure tax credit – and because tax credits produce 100 cents on the dollar to your bottom line, they’re far more valuable than tax deductions – may now be eligible for tax credits well into the six figures.

This may be the simplest and fastest way for many manufacturers to reduce payroll costs – with no layoffs required. Instead, job security is enhanced with a stronger bottom line cash position.

And it’s now more lucrative than ever. The average savings discussed next reflect cash benefits before the liberalized filing process that will significantly increase R&D tax credits…

Prove What You Know In Your Gut

You know you’re paying too much in taxes. Here’s your chance to prove it – and to do so with the IRS’ blessing when you conduct the kind of detailed engineering-based studies they recommend.

Relying on our national team of engineering, accounting, and intellectual property professionals with over a decade’s success saving clients billions in tax savings can…

- Optimize your tax savings – and optimization isn’t always maximization. Sometimes cautious conservatism is best advised;

- Reduces your risk of challenge – our firm has never been denied any tax savings found for our clients; and

- Assures quality work you demand for your business.

We’ve done this for hundreds of manufacturers like this one.

And that’s what lean thinking on taxes can do for your manufacturing business as well.

To use our online tax savings calculator for a free and instant estimate of your potential tax savings – based on our proven experience with thousands of clients’ tax savings and tax credits – click here.

xxx

____________________________

xxxx

This publication does not constitute professional advice.

IRS Circular 230 Disclosure – To ensure compliance with IRS requirements, you are informed that any U.S. tax advice contained in this communication (including any links or attachments) is not written or intended to be used, and cannot be used, to (i) avoid tax-related penalties under the Internal Revenue Code, or (ii) promote, market, or recommend to another party any transaction or matter addressed herein.

© 2015-2021 Peak Profits Advisors – All Rights Reserved

The contents of this web site and all related materials or printed matter are owned by Peak Profits Advisors and protected under the United States Copyright Act pursuant to U.S. and international copyright laws.

Privacy Policy | Terms and Conditions of Use | Website Disclaimer | Contact