ERC Credit Scams Harm Businesses

You’d have to be living under a rock as a business owner or manager in America to not have heard about the ERC credit – or Employee Retention Credit (ERC) or Employee Retention Tax Credit (ERTC). Your business can still claim the ERC credit as a reward for retaining employees in 2020-21 despite COVID-19’s business disruptions.

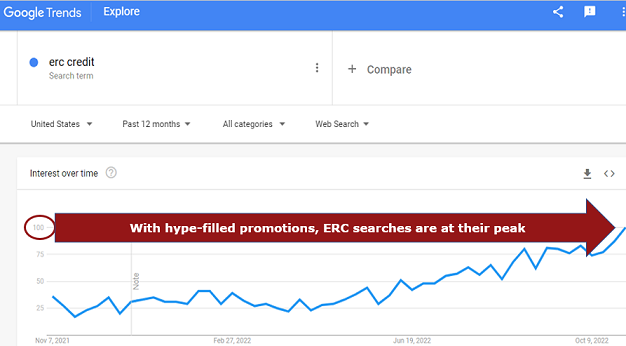

This seeming government giveaway, which can be claimed retroactively in 2022 and 2023, has attracted all manner of marketers and fly-by-night operators with little to no tax incentive experience.

It’s hard not to become jaded when your email inbox is flooded with spammy ERC messages and, in turn, dismiss the whole ERC thing out of hand.

That may explain why well over half of eligible U.S. companies are estimated to have failed to claim them.

This is why those who have hopped on the ERC bandwagon are harming more than helping U.S. businesses. That’s especially true for small and midsize businesses that may not have the resources to determine the true benefits of the ERC tax credit, as well as the risks if it’s handled improperly.

According to a recent article published by Accounting Today, the IRS “handled 840 cases of COVID fraud in recent years and is just shy of 400 indictments, part of a 98.9% conviction rate…with an average sentence of three years…” (“IRS criminal investigators ramped up probes this year”, 11/03/2022).

So, while it would be foolish to not take advantage of this generous employer tax incentive, you don’t want to get this wrong.

Here’s what else you need to know about this subject.

About That “Up To” $26k Per Employee

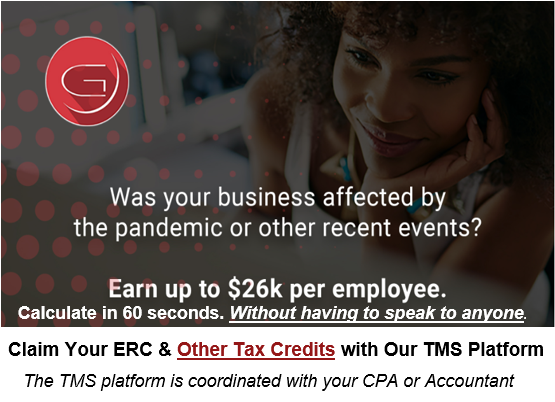

The ERC tax credit is a perfectly legitimate tax incentive that truly can generate up to $26,000 per employee, as advertised.

Any U.S. business, including non-profits, that was required to close or reduce operations from March 13 of 2020 through the first three quarters of 2021 because of the COVID pandemic, or that suffered revenue declines exceeding 20% compared to comparable periods in 2019, may be eligible.

The ERC tax credit can be claimed retroactively and remains available for eligible companies that have not yet claimed it.

And while the “up to” $26,000 per employee is correct, that’s not what a business is likely to average for its retained workforce.

Nevertheless, it’s reasonable to expect that most businesses with more than a handful of employees may realize five and maybe six figures in new cash flow for their businesses if they qualify.

Who Is Eligible for the ERC Credit?

Private employers, including non-profits, carrying on a trade or business during the period from March 13, 2020 to September 30, 2021, that:

- Had operations partially or fully suspended as a result of orders from a governmental authority due to COVID-19, or

- Experienced a decline in gross receipts by more than 20% (previously 50% in the CARES Act) in a quarter compared to the same quarter in 2019. Eligibility ends when gross receipts in a quarter exceed 80% of the same 2019 quarter.

As of June 1, 2020, employers who received a Paycheck Protection Program Loan (PPP) were not eligible for this tax credit. However, later coronavirus relief packages allowed access to both programs while avoiding double-dipping. Any payroll costs covered by a PPP loan can’t also be used to qualify for the ERC tax credit.

There are more nuances, including employment tax offsets and special provisions for “recovery startup businesses” that began operations after February 15, 2020, described further in this IRS report.

But the ERC Credit is Just a Start

The ERC credit is only one of hundreds of state and federal tax incentives available to U.S. businesses. These are incentives that Wall Street businesses leverage to bolster their bottom lines while most Main Street businesses remain in the dark.

The ERC credit fly-by-night operators have neither the experience, expertise nor system to screen businesses for, document eligibility for, or – in coordination with your CPA or Accountant – claim all those that your business qualifies to receive.

Your CPA or Accountant may have the necessary knowledge and experience to document and process your ERC tax credit eligibility. Many, however, turn to third party specialists in tax incentives to help them navigate its complexities.

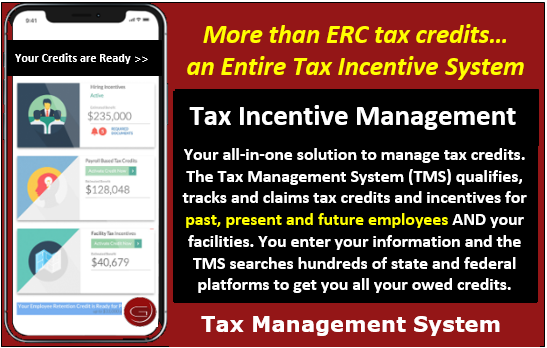

I work with one such specialist company and industry leader – Growth Management Group, or GMG – precisely because the Tax Management System (TMS) they’ve developed over the past 20 years screens businesses for much more than the ERC credit.

How So?

It starts by screening your business for ERC tax credits but adds screening for hundreds of other employee and facility tax incentives that add multiples in cash flow benefit to the ERC credit alone.

The combined savings from this broad range of state and federal tax incentives average well into the six figures and even seven figures for midsize companies, with much of it recurring annually.

And all of it falls straight to the bottom line – the AFTER-TAX bottom line.

Think of how many more new sales your business would need to transact to generate that kind of positive effect on your bottom line – after taxes!

This entire tax incentives management system is a streamlined process for identifying ALL the tax incentive savings your business qualifies for, not just the ERC credit.

And without having to speak to anyone if you don’t wish to.

If that’s of interest, you can get started now.