Reduce Your Business Property Tax

Stop Overpaying Business Property Taxes

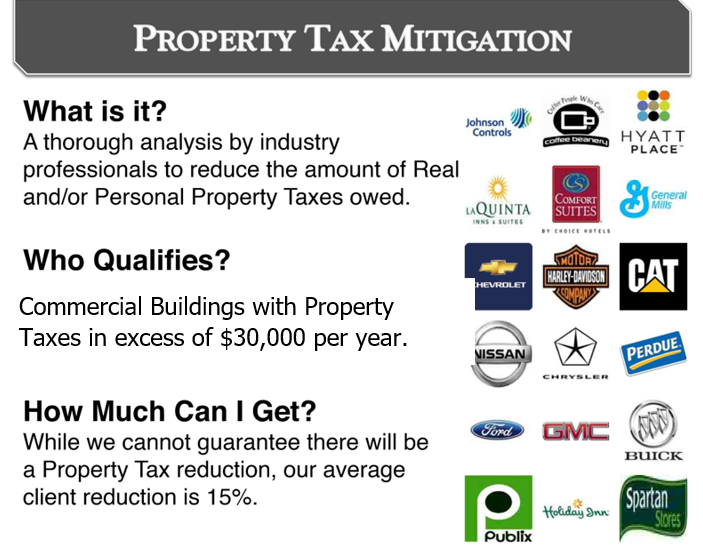

Most business owners realize they overpay in business property taxes, but feel helpless to do anything about it. There’s a way to fix this, however, with the right approach to capture 15% or more of recurring annual property tax savings and, in some cases, refunds of past overpayments.

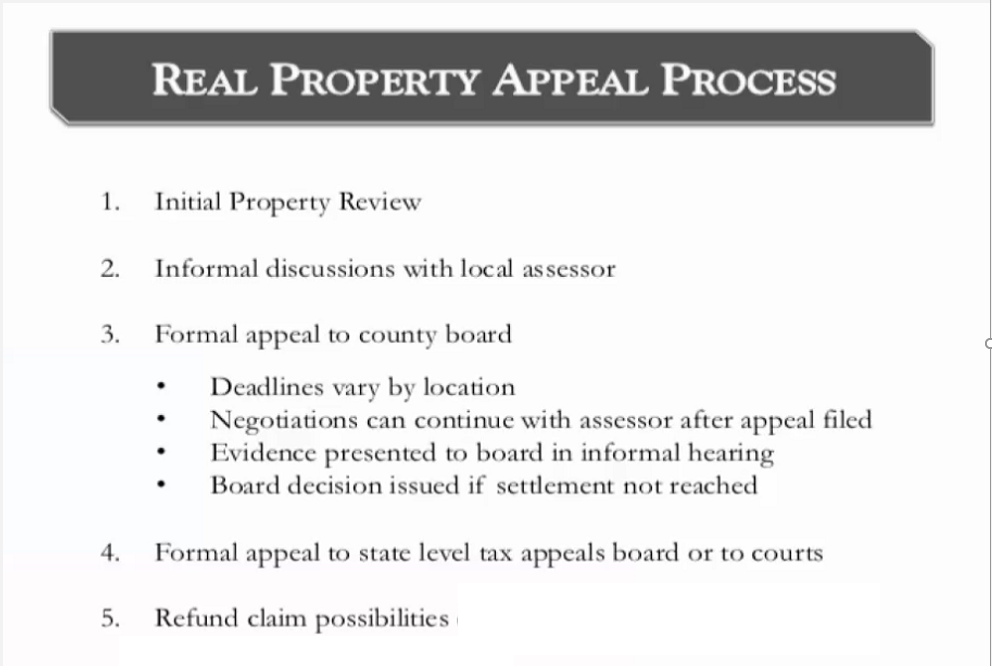

Commercial property tax appeal, however, isn’t a simple process. Many businesses shoot themselves in the foot by…

- Attempting to master it on their own, or

- Using overly aggressive lawyers in an adversarial approach that’s usually counter-productive (you risk a property tax increase – not a reduction – with this mistaken approach).

First a brief overview of the Property Tax Mitigation process and benefits to business owners…

A few case studies illustrate the potential commercial property tax benefit in dollars and cents…

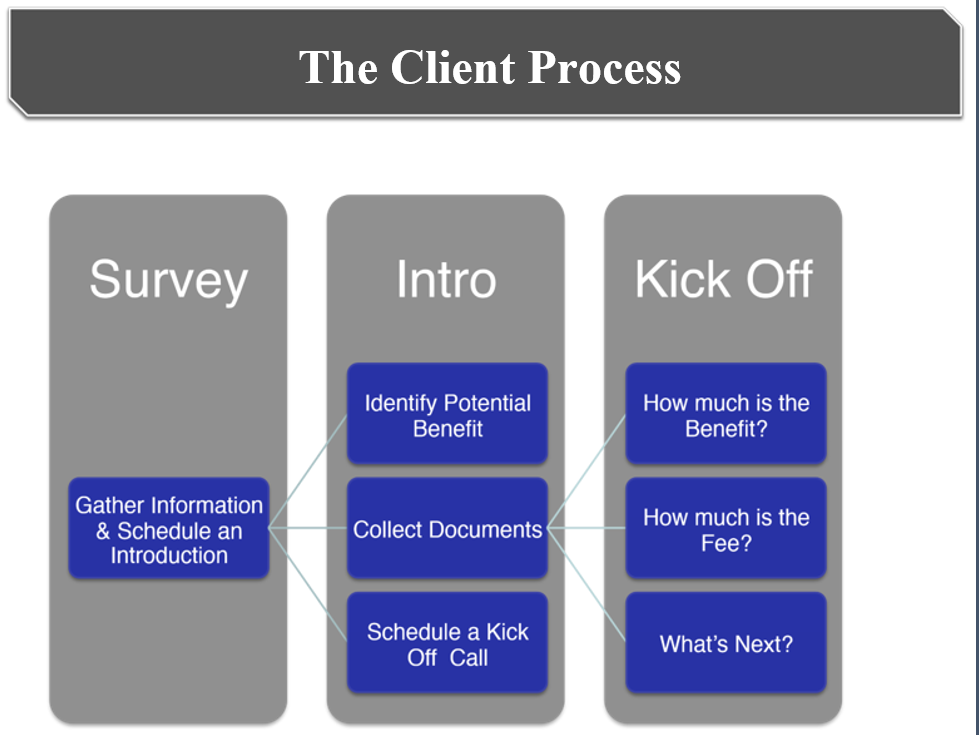

Following is a brief outline of how the process works, first from the client perspective and then how we proceed through the business property tax process with the taxing authority…

Over 90% of commercial real estate is eligible for abatement.

To learn how much in recurring business property tax savings your business may be eligible for, click the link below to schedule a 15-minute no-obligation walk-through of our client screening eligibility app…