How To Reposition Your Insurance Agency As a Trusted Advisor

Shifting Gears to Succeed in a COVID Economy

Have you found with your insurance agency that selling insurance has gotten a lot more complicated since the advent of the internet? And how has the ongoing coronavirus pandemic affected your business?

Even amid a pandemic, companies are still inundated with not just insurance competitors, but online vendors of SEO, social media and a host of related online services.

It’s not that these services aren’t needed. But their being added to the mix has drastically amped up the number of people vying for the attention of your prospects, including business prospects – many of which are struggling to stay afloat amid continuing pandemic-driven business disruptions.

These online vendors are every bit as much your competitors as your more traditional insurance agency competitors – and they’re not even in the same industry or profession.

But they’re very much competing for your prospects’ limited time, attention and dollars – making insurance agency marketing more challenging than ever.

Your Insurance Agency Prospects

Have Limited Bandwidth

Because so many businesses have less budget flexibility these days, the squeeze is on for your insurance agency to stand out from the crowd – to differentiate yourself from the growing ranks of your competition.

Otherwise you’re left with the business equivalent of ad blindness: just as consumers routinely ignore online banner ads, business owners and managers routinely ignore their deluge of phone calls, emails, drop by visits (remember those?), etc.

Now more than ever it’s imperative to differentiate your insurance agency – to become what Seth Godin has called a “purple cow” standing out from the herd.

Don’t Be Just Another Insurance Agency –

Provide Trusted Financial Advice, Too

Business clients and prospects are looking for more than insurance advice – they’re looking for in-depth business advice that will add to their bottom line growth.

Offering them a broad bundle of cost-saving services that add real value to their bottom lines will increase their dependence on your insurance agency and build loyalty for increased client retention.

But getting their attention requires a really BIG differentiator, not another “me too” insurance pitch.

If only there were a proven successful, highly ethical back-end fulfillment system you could adopt to do just that.

Well, now there is.

If your business growth has stalled – or worse – maybe it’s time to think about repositioning it for a more rewarding future.

Of course, it would be nice to be able to do so without without disrupting or compromising your existing insurance agency business.

The idea, after all, is to enhance your current income, not trade it for something else.

Even better would be adding services that are synergistic and amplify what your insurance agency currently offers. Broadening what you offer from insurance savings to tax and vendor savings for routine business expenses is one way to do that.

Think of it as adding a “Savings Division” to your insurance agency – and the engineering, tax, and other experts conducting the back-end work for you as being like the underwriters with whom you’re so familiar.

This means these are synergistic services that nicely complement what your insurance agency currently offers.

In addition, offering prospects savings outperforms selling by ten-to-one, especially when you’re able to offer them via a company with over 18 years’ experience saving businesses an average of over $240,000.

And here’s the best part…all of these tax-saving and expense reduction services are provided on a completely risk-free basis. In plain English, this means…

“No Savings, No Fee”

If the tax-related studies and vendor audits required to document your business clients’ and prospects’ eligibility for tax refunds, credits or vendor cost savings fail to produce savings for them, no payment will be due. This further removes this process from traditional selling and eliminates a major source of buying objections.

Because they’re not really “buying” anything, but are instead recovering previous overpayments. Your insurance agents won’t need to be masters of selling for this to prove persuasive for new client prospects – or for existing clients either.

And you won’t have to worry about recruiting qualified professionals for your insurance agency to do this additional work for you.

All of the back-end fulfillment work is done by trained professionals with extensive experience and success in securing refunds, credits and cost reductions for both tax and vendor overpayments. And once the process has begun for an initial cost savings, they’ll look for additional cost-saving opportunities that will add to your commissions.

Here are some of the businesses that have benefitted from these services…

Add Tax & Vendor Savings To

Your Insurance Agency

Book Of Business

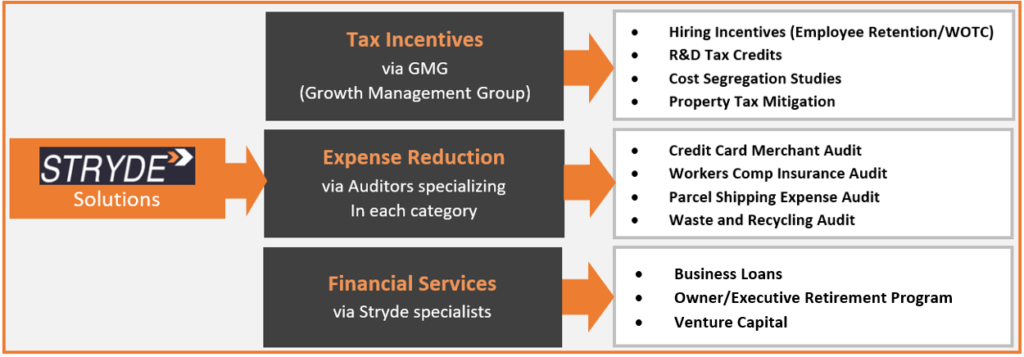

The risk-free tax and expense reduction service channels that are currently available for you to consider adding to your insurance agency offerings include:

Tax Refunds & Credits

- Property Tax Refunds – Appeals to local and state assessing authorities have produced average recurring savings of 15% in local property taxes;

- Income Tax Refunds – Based on engineering studies that reallocate client properties to properly accelerate depreciation that yields rapid P&L and cash flow benefit; and

- R&D, or Payroll, Tax Credits – Even better than tax deductions because a full 100 cents falls to the bottom line per dollar of tax credit. And vastly more businesses are eligible for tax credits that have been liberalized over the years, including loosening of regulations. The average manufacturer, for example, receives a $270,000 tax credit and your commission on that would exceed $7,000 – and overrides on those under you would exceed $2,400;

Vendor Refunds & Savings

- Merchant Credit Card Overcharges – Businesses that rely largely on credit cards to collect payments realize costly hidden overcharges due to routine errors and misclassifications. Commissions and overrides earned here persist for three years, which means they compound quickly and can account for much of your income growth;

- Workers Comp – If this doesn’t conflict with your current offerings, this is another area with significant overpayments due to misclassifications and clerical errors; and

- Parcel Shipping – FedX and UPS overcharges are common and also subject to audit recapture. Commissions here are paid monthly for the life of the client.

Property tax and credit card overpayments have proven the easiest door openers because so many businesses are perturbed by them. You’re then able to offer the other cost savings that they’re eligible for, along with your own book of business.

It’s important to note that none of the expense reduction services require clients or prospects to change their current carriers or providers. This is a major advantage over “switch-and-save” competitors.

Viable Prospects Abound

On average, almost seven out of ten businesses qualify for some kind of savings – and credit card processing audits find savings 100% of the time. Virtually every business in America can benefit from these services – and having no up-front cost for them to find out makes this a much easier proposition than selling insurance to businesses.

This may be the best business opportunity available today for your insurance agency. In addition to the obvious income potential, it affords the opportunity to turn your insurance agency from another expense for your prospects to an income-generator for them – and the timing couldn’t be more urgent for too many of them.

You already know your prospects are hard-wired to avoid added expenses. But they’re also hard-wired to be always on the lookout for more revenue. The former they avoid like the plague, the latter they’re eager to explore.

Which would you rather be – another business expense or a revenue-generator for them?

Your Five Powerful Benefits

There are at least five core benefits to this opportunity for your insurance agency, as summarized in this graphic and described briefly below:

1. Differentiation – This has already been discussed and may be the most obvious benefit to adding these tax and expense reduction services to your insurance agency’s existing book of business. Prospecting for new clients will only get harder with increasing competition from online and other vendors for your prospects’ limited time and attention (for a copy of our 12-Point COVID Checklist for agency differentiation, click here);

2. Diversification – One key lesson of today’s COVID-19 economy is it also makes sense from a diversification perspective to add other revenue sources to your insurance agency and improve your ability to withstand future business disruptions. And you can reduce the risk of that happening by strengthening your client relationships with cost-saving services your clients will love.

According to an article at propertycasualty360.com that applies to insurance of all types “Better selling: 10 tips, from prospecting to closing” – “There is gold in the clients you already have”. As noted there, “Sometimes, the most efficient prospecting comes from expanding the business you have with existing clients“;

3. Reposition – Insurance agents often get a bad rap. You can substantially reposition yourself as a business advisor bringing real bottom line value to your clients and prospects. When what your insurance agency offers prospects isn’t just another expense but actual cash flow benefit – much of it from the government! – you’ll be seen in an entirely different and more favorable light;

4. Residuals – Some of the half-dozen tax and cost recovery services you’ll be able to offer through your insurance agency provide recurring income, while others are routinely renewed by clients happy to repeat the process. This is doubly beneficial in that it first will improve client loyalty (i.e., more recurring revenue) and, secondly, in that some of the cost savings you’ll find will occur over time – those commissions will recur for several years; and

5. Leverage – In addition to the 7.5-30% commissions on fees generated from your own insurance agency business, you’re able to earn 2.5% % overrides on fees generated by non-employees you bring in under you.

This isn’t chump change. Your commissions can exceed five-figures per client for your own business and average in the low-four-figures per client in overrides. That’s because many businesses will qualify for several of these services, meaning you’ll need fewer client closings to produce these results.

For this reason, these tax services are best offered as a tax-savings bundle rather than individually. Once underway, you can cross-sell the expense reduction services and/or your current offerings.

The role of your insurance agency in all this is simply to screen clients and prospects with a simple online tool and schedule follow-up interviews with our specialized tax experts for any services where they’re likely to see savings.

With the training and support provided, this could match or exceed the current income of your insurance agency – perhaps substantially. And it’ll be easier to close while repositioning you on a sturdier and more lucrative business foundation to better withstand whatever curve balls the ongoing pandemic – and any future business disruptions – have to offer.

If you’d like to learn more about this unique business opportunity, click here.

Privacy Policy | Terms and Conditions of Use | Website Disclaimer | Contact