About

About John Lynch & Peak Profits Advisors

Welcome to Peak Profits Advisors – the answer to how best to grow your business profits…quickly and permanently.

I founded Peak Profits Advisors to help business owner clients recover past over-payments of taxes and vendor fees, achieve future cost savings, and grow revenues with strategic sales and marketing initiatives and to build a team of like-minded business consultants to extend these Wall Street cash flow strategies to more Main Street businesses across America.

I founded a company – Medical Diagnostics, Inc (MDI) – we took public as the only profitable MRI company in its sector with productivity more than twice industry averages.

MDI was selected by Business Week as a “Hot Growth Company” and one of the Top Ten “Best Small Companies” in America.

I’ve also been a business consultant and Seminar Speaker on consulting and strategic planning at MIT’s Sloan School of Management.

Helping YOU Become a Hot Growth Company

After selling my business and pursuing other interests, I decided to return to consulting to help revitalize other small and medium-size businesses achieve the kind of success I found with my own business.

I’ve teamed up with best-in-class experts in related business specialties, including Stryde Solutions and Growth Management Group (GMG) for its engineering, accounting, and intellectual property expertise. These skills are required for cost segregation studies and research and development tax credit studies that recover tax over-payments and claim tax credits for which clients are eligible.

These tax minimization and optimization services are provided by GMG with more than 19 years of success in securing billions in client tax savings – and never having a dollar of savings claims denied. Initial evaluation and analysis services are provided on a risk-free basis – No Savings, No Fee.

Specific capabilities offered include:

- Specialized Tax Incentives – The majority of businesses in America have overpaid federal and state income taxes and local property taxes due to inflated property valuations and building component misclassifications that depreciate many building and renovation costs more slowly than they should, resulting in tax over-payments. Others fail to claim tax credits for hiring employees from disadvantaged populations targeted by the government and for legitimate costs in pursuing manufacturing and design improvements, which are much more available for routine product and process activities than most businesses realize.

- Cost Reduction – Merchant credit card fees, workers compensation premiums, freight and shipping charges, and other vendor costs are also common areas of significant over-payments. Correcting these mistakes and payment oversights – like unclaimed discounts – requires intensive auditing, but that can be outsourced with minimal impact on business operations. And the impact on business cash flow and future expenditures can easily reach six figures and more.

- Financial Services – Stryde’s corporate loans close at a rate that’s four times greater than traditional bank loans due to the broad and deep network of direct and alternative lenders and investors. The Stryde Retirement Program (SRP) is uniquely positioned as a non-qualified plan that can cover owners and executives selectively – unlike qualified plans – yet provide the tax advantages of qualified plans, offering a broad range of industry-unique retirement, succession, exit planning and other creative advantages that are without competition.

All tax and cost recovery analyses are available on a contingent fee basis – no savings, no fee.

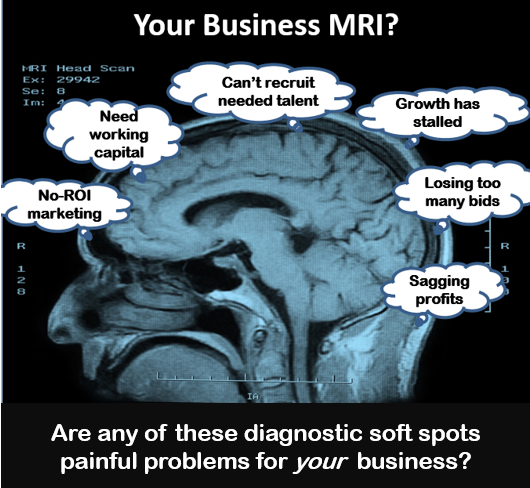

This post – “Need a Cash Flow MRI?” – recalls my own past struggles with cash flow…

Could YOUR Business Use a Profit Boost?

If so, our fast-track approach can often produce six-and-seven figure cash flow benefits for tax-paying U.S. companies in a matter of weeks.

This can include retroactive recovery of past over-payments for lump-sum cash benefits and reduced tax and vendor costs going forward.

If you’d like an instant estimate of the potential tax savings for your business, click the link below.

To get your Free & No-Obligation

Tax Savings Estimate, click here.